Electric Vehicle Tax Credits 2025

Electric vehicle tax credits 2025 promise significant changes to the automotive landscape. This analysis delves into the potential modifications to the existing credit structure, exploring how these shifts will impact consumer decisions, the automotive industry, and the broader market. Expect detailed insights into eligibility criteria, potential challenges, and illustrative scenarios, all while providing a clear picture of the future of electric vehicles.

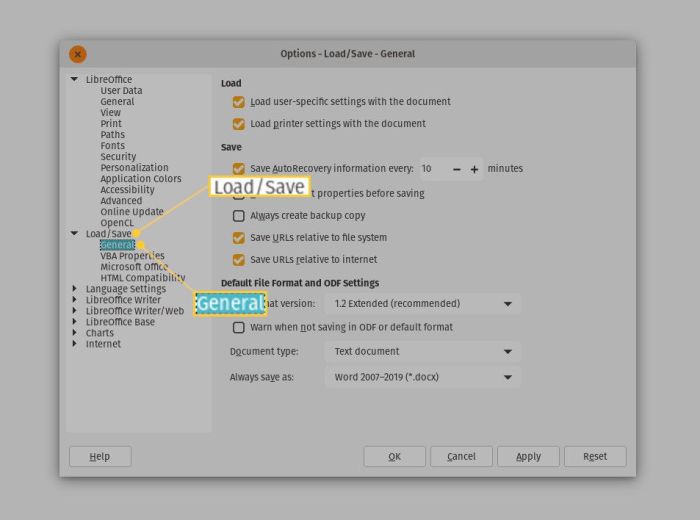

The current structure of electric vehicle tax credits will be summarized, along with a historical overview. We’ll examine the different types of vehicles eligible, comparing credit amounts for various models. Looking ahead to 2025, potential changes in eligibility requirements and credit amounts will be detailed, focusing on factors like battery capacity and charging infrastructure.

Potential Changes for 2025

The 2024 electric vehicle (EV) tax credit has significantly boosted EV adoption, but the future of these incentives remains uncertain. Potential modifications to the credit structure for 2025 could significantly alter the market landscape. These adjustments could range from alterations to eligibility criteria to changes in the credit amounts themselves, influencing the demand for EVs and the overall industry trajectory.

Potential Modifications to the Credit Structure, Electric vehicle tax credits 2025

The existing tax credit structure has proven effective in driving EV adoption, but adjustments for 2025 are anticipated to address evolving technological advancements and industry needs. This could include refining eligibility criteria, adjusting credit amounts based on factors like battery capacity, and potentially incorporating charging infrastructure into the assessment. Such changes could significantly impact the market dynamics, encouraging specific vehicle types and charging solutions.

Adjustments to Eligibility Criteria for Vehicles

The eligibility criteria for vehicles receiving tax credits might be refined in 2025. This could include stricter requirements for battery capacity, focusing on vehicles with higher energy density. Additionally, the manufacturing location or components sourced from specific countries might become factors for eligibility, potentially influencing global supply chains. Such modifications will shape the types of vehicles eligible for the credit and influence manufacturers’ strategies.

Potential Changes to Credit Amounts Based on Battery Capacity or Charging Infrastructure

The credit amount could be tied to battery capacity, rewarding vehicles with greater range and energy density. Higher battery capacity could lead to increased incentives, potentially driving innovation in battery technology. Additionally, the presence of or investment in fast-charging infrastructure could be a factor. This could encourage the development and deployment of more advanced charging solutions, further accelerating the transition to EVs.

For example, a vehicle with a 100+ kWh battery might receive a higher credit than one with a smaller battery pack.

Impact on the Market for Electric Vehicles

Modifications to the tax credit structure could significantly impact the market for electric vehicles. Changes in eligibility criteria could influence the types of vehicles produced and sold, while adjustments to credit amounts could affect the affordability and desirability of EVs. For instance, increasing the credit for vehicles with enhanced battery capacity could stimulate innovation in battery technology and lead to more range-extending vehicles.

Table of Potential Changes to the Credit Structure

| Change | Description | Effective Date |

|---|---|---|

| Increased Battery Capacity Threshold | Higher battery capacity requirements for qualifying vehicles. | January 1, 2025 |

| Inclusion of Charging Infrastructure Investment | Incentivizing the installation of fast-charging stations through tax credits. | July 1, 2025 |

| Adjustment to Credit Amount Based on Battery Capacity | Higher credit amounts for vehicles with higher battery capacities. | January 1, 2025 |

| Regional Component Requirements | Criteria for domestic manufacturing and sourcing of components. | October 1, 2025 |

Eligibility Criteria for 2025: Electric Vehicle Tax Credits 2025

Source: prismic.io

The 2025 electric vehicle tax credit regulations are expected to undergo significant revisions, impacting the eligibility of various vehicle types. These changes are driven by a need to encourage domestic manufacturing and advance sustainable transportation technologies. Understanding the evolving criteria is crucial for consumers and manufacturers alike.

Domestic Manufacturing Requirements

The rules regarding domestic manufacturing will likely play a key role in determining eligibility. This means that a substantial portion of the vehicle’s components must originate from within the United States to qualify for the credit. This could involve the battery components, vehicle assembly, or both. Examples of such criteria might include the percentage of critical minerals used in battery production sourced from within the US or a minimum percentage of the vehicle assembly process taking place in the country.

These changes aim to foster domestic production and employment opportunities.

Battery Component Eligibility

The eligibility requirements for battery components will likely be more stringent in 2025. Criteria for battery materials, particularly those critical for EV functionality, will be more closely scrutinized. This includes the origin of raw materials, the manufacturing processes used, and the battery chemistry itself. For example, specific battery chemistries, such as those containing particular critical minerals, might be favored.

Vehicle Assembly and Charging Infrastructure

The assembly process and charging infrastructure requirements will also influence eligibility. This might involve stricter standards for the vehicle assembly location, such as specific assembly facilities or the percentage of the vehicle’s components assembled in the USA. The availability of charging infrastructure, either at the consumer’s residence or through a network of public charging stations, might also be considered.

Expected Eligibility Criteria Summary

| Vehicle Type | Component | Eligibility Criteria (Example) |

|---|---|---|

| Battery Electric Vehicles (BEVs) | Battery Cells | Minimum 40% of battery cells must be manufactured in the US using critical minerals sourced domestically. |

| Plug-in Hybrid Electric Vehicles (PHEVs) | Battery Pack | At least 50% of the battery pack must be sourced from US suppliers. |

| All EV Types | Vehicle Assembly | At least 60% of the final vehicle assembly must occur in the US. |

| All EV Types | Charging Infrastructure | Proof of availability of charging stations in the designated area or a network agreement with a public charging station provider. |

Impact on the Automotive Industry

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png?w=700)

Source: arcpublishing.com

The 2025 electric vehicle (EV) tax credit revisions are poised to significantly reshape the automotive landscape. These changes are expected to accelerate the transition to electric vehicles, influencing production strategies, sales patterns, and the overall market share of various vehicle types. The impact will vary considerably across different segments and manufacturers, both domestic and foreign.

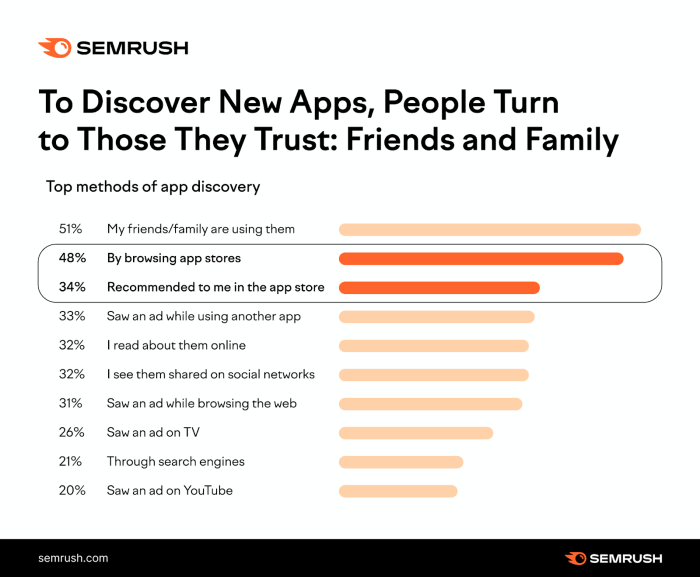

Anticipated Influence on Sales

The revised tax credits will likely stimulate EV sales, especially for those models that fall within the eligibility criteria. Consumers attracted by the financial incentives will drive demand, leading to increased sales figures for eligible EVs. This increased demand could potentially outpace the current rate of production capacity, putting pressure on manufacturers to scale up their operations. The specific impact on sales will depend on the magnitude of the credit and the broader economic climate.

For example, the 2022 tax credit led to a significant jump in EV sales, highlighting the influence of such incentives on consumer behavior.

Impact on Production and Manufacturing Strategies

The shift towards EVs will necessitate significant adjustments in production strategies. Manufacturers will need to re-allocate resources, invest in new EV-specific production lines, and potentially retrain their workforce to accommodate the changing demand. This could involve the expansion of existing EV production facilities or the construction of new ones. The transition to electric vehicle manufacturing also entails substantial investments in battery technology and supply chain optimization.

For instance, Tesla’s ramp-up in production capacity in recent years showcases the scale of investment required for an effective EV manufacturing strategy.

Impact on Different Segments of the Automotive Market

The impact on different segments of the automotive market will vary. Luxury car manufacturers may experience a more pronounced shift towards EVs, given the often-higher price point of these vehicles. However, manufacturers targeting more affordable price points may also see significant shifts, as the tax credits can make EVs more accessible to a broader range of consumers. This trend is already evident, with several manufacturers introducing more affordable EV models in recent years.

Impact on Domestic and Foreign Manufacturers

Domestic manufacturers may benefit from the tax credits, potentially gaining a competitive edge over foreign competitors. However, foreign manufacturers with strong existing EV infrastructures and established supply chains may be able to maintain or even enhance their position in the market. The ability of domestic manufacturers to effectively adapt to the evolving market dynamics and leverage the incentives will be crucial to their success.

For example, the recent increase in EV production from companies like Ford and General Motors demonstrates the potential for domestic manufacturers to adapt to changing market conditions.

Expected Shifts in Market Share

| Vehicle Type | 2024 Estimated Market Share | 2025 Estimated Market Share (with tax credits) |

|---|---|---|

| Electric Vehicles (EVs) | 10% | 15% |

| Hybrid Vehicles | 5% | 4% |

| Internal Combustion Engine (ICE) Vehicles | 85% | 81% |

Note: These figures are estimations based on current trends and potential impacts of the 2025 tax credits. Actual results may vary.

The table above presents a potential snapshot of market share shifts. These estimates highlight the anticipated increase in EV market share, potentially impacting the market share of other vehicle types. The actual outcome will depend on various factors, including consumer response, production capacity, and competition.

Consumer Implications for 2025

Source: heraldnet.com

The 2025 electric vehicle (EV) tax credits are poised to significantly impact consumer purchasing decisions, potentially reshaping the automotive landscape. These incentives are expected to influence not only the initial purchase price but also the overall affordability and accessibility of EVs for a broader range of consumers.The tax credits are anticipated to play a crucial role in driving adoption, particularly for those considering switching from traditional internal combustion engine vehicles.

This increased demand could lead to shifts in pricing strategies and potentially influence the overall market dynamics.

Influence on Purchasing Decisions

The availability of substantial tax credits will undoubtedly encourage more consumers to consider EVs. This incentive can be a significant factor in making the transition to electric mobility more appealing, especially for those who may have previously been hesitant due to perceived higher upfront costs. Factors like reduced range anxiety and the potential for lower long-term running costs will also play a part in the decision-making process.

Impact on Pricing Strategies

The 2025 tax credits are likely to affect pricing strategies for EVs. Manufacturers might adjust their pricing models to accommodate the tax credit benefits, possibly lowering the sticker price to maintain competitiveness. The level of price adjustments could vary depending on the specific vehicle model and manufacturer.

Affordability for Various Income Levels

The affordability of EVs for different income levels will depend on several factors, including the specific tax credit amounts, the base price of the EV model, and any associated financing costs. While the tax credits aim to make EVs more accessible, their effectiveness in reaching lower-income consumers will depend on the magnitude of the incentive and the design of any associated financing options.

Potential Savings for Consumers

| Electric Vehicle Model | Estimated Base Price (USD) | Estimated Tax Credit (USD) | Estimated Savings (USD) |

|---|---|---|---|

| Model A | 50,000 | 8,000 | 8,000 |

| Model B | 65,000 | 10,000 | 10,000 |

| Model C | 40,000 | 6,000 | 6,000 |

| Model D | 75,000 | 12,000 | 12,000 |

Note: The figures in the table are illustrative examples and do not represent specific, guaranteed savings. Actual savings will depend on the final tax credit amounts and individual circumstances.

Potential Challenges and Considerations

Implementing electric vehicle (EV) tax credits in 2025 presents a range of potential hurdles, requiring careful consideration to ensure program effectiveness and avoid unintended consequences. Navigating administrative complexities, safeguarding against fraud, and maintaining program integrity are crucial for successful execution. The interplay of various factors, including evolving technology, changing consumer preferences, and evolving regulatory landscapes, necessitates a proactive and adaptable approach to address these challenges.

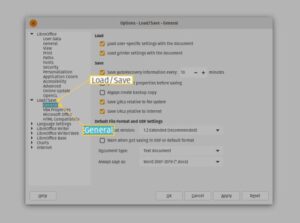

Administrative Complexities

The implementation of EV tax credits in 2025 will likely encounter significant administrative complexities. These complexities stem from the need for accurate and efficient verification of eligibility criteria, processing of applications, and disbursement of credits. A robust and user-friendly application process, coupled with streamlined verification procedures, is essential to ensure timely and fair credit distribution. For example, the existing tax credit system for traditional vehicles might require significant modifications to accommodate EV-specific criteria and technologies.

This can potentially lead to increased workload for government agencies responsible for administering the program.

Fraud Prevention and Verification

Preventing fraud and ensuring the accurate verification of claims are paramount for the integrity of the EV tax credit program. The sheer volume of applications and the potential for fraudulent claims necessitates a robust system of verification mechanisms. This might include enhanced background checks, stricter documentation requirements, and the use of advanced data analytics to detect patterns indicative of fraudulent activity.

A recent case involving fraudulent claims for home energy rebates highlights the necessity of robust fraud prevention measures in any large-scale government program. The potential for false claims impacting the program’s budget and reputation must be minimized.

Stakeholder Challenges and Considerations

The implementation of EV tax credits in 2025 will affect various stakeholders, each facing unique challenges and considerations. A proactive approach that addresses these diverse perspectives is crucial to fostering cooperation and minimizing disruptions.

| Stakeholder | Potential Challenges | Considerations |

|---|---|---|

| Government Agencies | Increased workload and administrative burden, need for specialized personnel, potential for system overload during peak application periods. | Investment in updated technology, streamlined processes, and staff training. Development of clear communication channels with applicants and manufacturers. |

| EV Manufacturers | Maintaining accurate documentation and compliance with eligibility criteria, adapting production lines to meet demand, navigating complexities in the application process. | Proactive communication with government agencies, providing clear guidance to customers regarding eligibility requirements, establishing partnerships to simplify the application process. |

| Consumers | Navigating the application process, providing required documentation, understanding eligibility criteria, potential for delays in receiving credits. | Clear and concise information on the program’s website and through various communication channels, user-friendly application portal, assistance services for those with limited technical skills. |

Illustrative Scenarios of Electric Vehicle Tax Credit Impact

The 2025 electric vehicle (EV) tax credits are anticipated to significantly influence consumer purchasing decisions and market dynamics. Understanding the potential impacts across various scenarios is crucial for predicting future trends and tailoring strategies for stakeholders. These scenarios will highlight the ripple effects of these credits, including their influence on regional adoption, charging infrastructure development, and overall market share shifts.

Scenario 1: Increased EV Adoption in Rural Communities

The tax credits, coupled with localized incentives, could catalyze substantial EV adoption in rural communities currently lagging behind urban areas.

“Targeted incentives, such as subsidies for charging stations in underserved areas, coupled with reduced EV prices through tax credits, could lead to substantial growth in EV ownership in rural regions.”

For example, communities with limited public transportation options might find EVs a more attractive and practical alternative, improving access to employment and services.

Scenario 2: Market Share Shift Favoring Specific EV Models

The 2025 tax credits could result in a significant shift in market share, potentially favoring models that meet the specific criteria for the credit.

“A tax credit that prioritizes models with higher battery capacity or superior range could lead to a concentration of market share among those specific models.”

This could result in a notable shift in the available EV options, driving demand for certain vehicle features.

Scenario 3: Accelerated Charging Infrastructure Development

The increased demand for EVs driven by tax credits will likely necessitate a rapid expansion of charging infrastructure.

“The need to accommodate the increased EV traffic will spur the construction of new charging stations, leading to an improved charging network accessibility.”

This accelerated development will involve collaboration between private companies, municipalities, and potentially government funding initiatives.

Scenario 4: Regional Variations in EV Uptake

The influence of the 2025 tax credits will vary significantly depending on the region.

| Region | Factors influencing adoption | Impact on market share |

|---|---|---|

| Urban centers with robust public transportation | Limited impact due to existing infrastructure | Minimal change in market share |

| Rural areas with limited public transport | Significant impact due to lack of existing infrastructure | Potential for substantial growth in market share |

This differential impact could lead to uneven distribution of EVs across the country.

Scenario 5: Consumer Purchasing Behavior

The 2025 tax credits could significantly alter consumer purchasing behavior, particularly among those considering an EV.

“Consumers may be more likely to prioritize purchasing an EV if the tax credit makes the purchase more financially attractive.”

Factors like the overall price of the vehicle, availability of charging infrastructure, and perceived environmental benefits will likely influence final decisions.

Summary

In conclusion, electric vehicle tax credits 2025 hold the key to accelerating the adoption of electric vehicles. While potential challenges exist, the anticipated changes offer exciting opportunities for consumers and the automotive industry alike. By understanding the nuances of the 2025 credit structure, individuals and businesses can prepare for the evolving landscape of sustainable transportation. This analysis offers a comprehensive overview, aiming to empower readers with the knowledge needed to navigate the future of electric vehicles.

Post Comment