Electric Car Insurance Costs And Factors

Electric car insurance costs and factors is a crucial aspect of EV ownership. This comprehensive guide explores the nuances of insuring an electric vehicle (EV) compared to traditional gasoline-powered cars. We’ll examine the historical development of EV insurance, the key differences in coverage, and the factors that influence premiums. From safety features to driving habits, we’ll uncover the complete picture of EV insurance.

Understanding the intricacies of electric car insurance is essential for prospective EV owners. This involves examining the specific coverage needs for EVs, such as battery damage and theft, and how these factors affect the overall cost of insurance. We’ll also discuss the claim process, insurance provider strategies, and future trends in the EV insurance market.

Introduction to Electric Car Insurance

Source: com.au

Electric vehicle (EV) insurance operates similarly to traditional car insurance, but with some key distinctions. This involves covering damages, liabilities, and other potential risks associated with owning an EV. Crucially, factors unique to EVs, such as battery damage and specific repair needs, influence insurance premiums.The fundamental principle remains the same: to protect the policyholder from financial losses due to unforeseen events related to vehicle ownership.

However, the evolving nature of EV technology necessitates a nuanced approach to insurance coverage. This is reflected in the evolving insurance market and policies that adapt to these changes.

Differences Between EV and Traditional Car Insurance

Insurance policies for electric vehicles (EVs) differ from those for traditional gasoline-powered vehicles primarily due to the distinct technological characteristics of EVs. This difference manifests in factors influencing the cost and coverage. These distinctions are crucial to understand for potential EV owners.

- Battery Damage Coverage: Traditional car insurance policies often don’t specifically address battery damage. EV insurance policies, conversely, usually include specific coverage for battery damage or malfunction, arising from accidents, fire, or other events. This tailored coverage is essential given the significant investment in EV batteries.

- Repair Costs: Repairing damage to an EV often involves specialized expertise and parts. The cost of repairs can be significantly higher than for traditional vehicles, especially for battery-related issues. EV insurance policies often factor in these higher repair costs and associated expenses.

- Liability Coverage: While the basic principles of liability coverage remain the same, the potential for unique incidents, like battery fires or other technological failures, may be explicitly covered or excluded in some policies. Understanding the specifics of liability coverage is paramount for responsible EV ownership.

Historical Context of EV Insurance Development

The evolution of EV insurance reflects the growth of the EV market. Initially, insurance companies adapted existing policies, but as EV adoption increased, the need for specialized coverage became apparent. Insurance companies began offering tailored policies to account for the unique risks associated with EV ownership, such as battery damage and high repair costs. The current state of EV insurance is a direct result of this historical evolution.

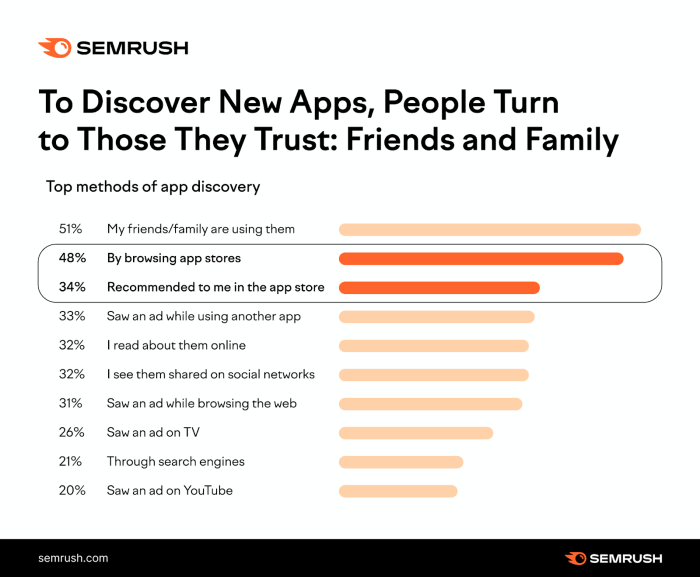

Comparison of EV and Traditional Car Insurance

| Feature | Traditional Car Insurance | EV Insurance |

|---|---|---|

| Battery Damage Coverage | Usually not included | Typically included |

| Repair Costs | Typically lower for standard repairs | Potentially higher, especially for battery-related issues |

| Liability Coverage | Covers standard liabilities | May include specific coverage for EV-related incidents |

| Premium Costs | Vary based on factors like vehicle model, usage, and driver history | Can vary, often reflecting the higher repair costs and potential risks associated with EV technology |

Factors Affecting Electric Car Insurance Costs

Source: bajajallianz.com

Electric vehicle (EV) insurance premiums are influenced by a complex interplay of factors, distinct from those affecting traditional gasoline-powered cars. Understanding these differences is crucial for EV owners to manage their insurance costs effectively. These factors, while potentially higher initially, often reflect specific risks and challenges associated with the newer technology.

Key Factors Influencing EV Insurance Premiums

Several factors contribute to the cost of insuring an electric vehicle. These factors are often intertwined and can significantly impact the overall premium. The unique characteristics of EVs introduce new considerations compared to traditional internal combustion engine (ICE) vehicles.

- Driving Habits: Aggressive driving, frequent hard braking, and high speeds are common risk factors in car insurance, regardless of the vehicle type. However, EVs have unique characteristics. For example, the instant torque delivery of EVs can lead to more rapid acceleration, which could be interpreted as riskier driving. The regenerative braking system of EVs might also contribute to a perceived increased risk depending on the insurance provider’s assessment of braking practices.

- Location: High-theft areas, accident-prone zones, and areas with higher rates of severe weather events all influence insurance premiums. This applies equally to EVs and traditional vehicles. For instance, areas with frequent hailstorms may see higher insurance costs across all types of vehicles. However, some EVs may have different theft-related risks compared to ICE vehicles.

- Vehicle Features: Features such as advanced driver-assistance systems (ADAS) can reduce insurance costs for both EVs and ICE vehicles. However, the presence of advanced features in EVs may not always translate into the same level of premium reduction as in traditional vehicles. For example, the presence of advanced safety features in an EV might not always result in the same insurance premium discount as a similar feature in a traditional vehicle.

Usage Patterns and Insurance Premiums

Insurance companies analyze driving habits and mileage to assess risk. For EVs, usage patterns become especially crucial, as they directly correlate with battery health and overall vehicle performance. Frequent charging at home, for instance, may indicate lower risk compared to charging at public stations with potentially higher theft or vandalism concerns.

- Charging Habits: Insurance companies might consider the frequency and location of charging. Frequent charging at home, or using designated EV charging stations with enhanced security, might indicate a lower risk. Conversely, charging at public locations with varying security levels could contribute to a higher risk assessment.

- Mileage: High mileage often translates to higher wear and tear on the vehicle, affecting both EV and ICE vehicles. However, the impact of mileage on EV insurance costs could be further nuanced by considering factors such as the charging infrastructure and the overall driving habits of the owner.

Coverage Types and EV Insurance Premiums

The coverage options available for EVs are similar to those for traditional vehicles. However, certain coverages might have a slightly different impact on the premium. For instance, comprehensive coverage, addressing damage from events like vandalism or weather, may vary in impact based on factors like location and charging habits.

| Coverage Type | Impact on Premiums |

|---|---|

| Collision | Premiums are generally affected similarly to traditional vehicles, reflecting the risk of damage in an accident. |

| Comprehensive | Premiums may vary depending on the frequency and location of charging, as well as the overall security measures surrounding the vehicle. |

| Liability | Premiums are generally affected similarly to traditional vehicles, reflecting the risk of legal liability in an accident. |

| Uninsured/Underinsured Motorist | Premiums may be affected based on the perceived risk of accidents involving uninsured drivers. |

Coverage Specific to Electric Vehicles

Electric vehicle (EV) insurance often presents unique considerations compared to traditional internal combustion engine (ICE) vehicles. These differences stem from the distinct components and potential risks associated with EVs, particularly battery damage and theft. Understanding these nuances is crucial for securing appropriate coverage.Comprehensive and collision coverage for EVs requires careful evaluation of potential risks. While traditional vehicles primarily face damage from collisions and impacts, EVs also face the risk of battery damage, fire, and potential water damage from various incidents.

The higher cost of replacing or repairing EV batteries necessitates a more tailored approach to coverage.

Battery Damage Coverage

Battery packs in EVs are expensive and complex. Damage to the battery, whether from a collision, fire, or other incident, can significantly impact the vehicle’s value and functionality. Standard comprehensive policies often cover battery damage, but the extent of coverage can vary. Policyholders should carefully review their policy documents to understand the specific stipulations related to battery damage.

For example, a specific deductible for battery repairs might be part of the policy.

Theft Coverage

EVs, due to their higher price point and unique components, are more vulnerable to theft than traditional vehicles. Insurance providers often offer specialized theft protection options, including additional coverage for high-value parts, such as the battery. The specific measures for theft protection may vary based on the location and the vehicle’s characteristics.

Comprehensive and Collision Coverage for EVs

Comprehensive coverage for EVs should encompass not only the vehicle’s exterior and interior but also the high-value battery pack. Collision coverage should adequately address potential damage to the battery from an accident. The increased cost of EV repairs and replacements necessitates ensuring that coverage aligns with the current market value. Collision coverage for an EV should likely be more comprehensive than for a comparable traditional vehicle.

Comparison of Coverage Options

| Coverage Type | EV Coverage | Traditional Vehicle Coverage |

|---|---|---|

| Comprehensive | Covers damage from various events, including fire, vandalism, and hail, plus battery damage. | Covers damage from various events, excluding battery damage. |

| Collision | Covers damage resulting from collisions, including damage to the battery. | Covers damage resulting from collisions. |

| Theft | Often includes higher coverage limits for the battery and other high-value components. | Standard coverage for the vehicle. |

Types of EV Insurance Policies, Electric car insurance costs and factors

Several insurance policies are designed to cater to the unique needs of EV owners. These policies may offer enhanced coverage for battery damage, theft, or specific incidents. Some insurance providers may offer special EV-specific policies with tailored coverage. These options might include enhanced coverage for accidents involving fire or water damage, which can be particularly relevant for EVs.

Exclusions in EV Insurance Policies

Insurance policies often contain exclusions for certain situations. These exclusions may include damage resulting from wear and tear, neglect, or misuse. Specific situations, like using the vehicle for commercial purposes or in high-risk activities, might also be excluded from coverage. Policyholders should carefully review the exclusions Artikeld in their policy documents to understand the limitations of their coverage.

Claims Process for Electric Vehicles

The claim process for electric vehicles (EVs) shares similarities with traditional vehicles but also presents some unique considerations due to the distinct components and technologies involved. Understanding these differences is crucial for both policyholders and insurance providers to ensure a smooth and efficient claim resolution.

Potential Differences in the Claim Process

The claim process for EVs often involves specialized expertise due to the presence of high-voltage systems, advanced battery packs, and intricate motor components. This necessitates a different approach compared to traditional vehicle repairs. Damage assessment may require specialized tools and trained technicians to evaluate the extent of damage to the battery pack, motor, or other EV-specific parts.

Steps Involved in Filing an EV Claim

The process typically begins with reporting the incident to the insurance company, much like with a traditional vehicle. Policyholders must provide details about the accident, including the location, time, and other relevant circumstances. The next step usually involves a damage assessment, which is more intricate for EVs due to the unique components.

- Report the incident to the insurance company.

- Provide details about the accident, including location, time, and other relevant circumstances.

- Arrange for an inspection and evaluation of the damage by an authorized EV technician.

- The insurance company will assess the damage and determine the amount of compensation.

- Negotiate the repair or replacement of damaged components.

- The repair process often involves specialized parts and tools, which may lead to longer repair times compared to traditional vehicles.

Repair Procedures for EV Components

Repairing EV components, such as battery packs and motors, frequently differs significantly from traditional vehicle repairs. Battery packs often require specialized handling due to safety precautions and potential for fire risk. Specialized technicians and equipment are often necessary for accurate diagnoses and safe repairs.

- Battery Pack Repair: Replacing or repairing battery packs often involves extensive testing and calibration procedures to ensure proper functionality and safety. This process may require a complete replacement of the battery pack or specialized repairs to specific cells.

- Motor Repair: Repairing electric motors typically involves diagnostics to determine the specific damage and appropriate repair methods. Motor repairs might involve component replacement or intricate adjustments to ensure optimal performance.

- High-Voltage System Repair: Repairing high-voltage systems requires careful handling and specialized equipment. Safety procedures and protocols are paramount during this stage, and trained technicians must be involved to avoid electrical hazards.

Documentation Required for EV Claims

Accurate and complete documentation is critical for a smooth and efficient EV claim process. This documentation should include details of the accident, the damage assessment report from a qualified technician, and all repair invoices.

- Copy of the insurance policy.

- Police report (if applicable).

- Damage assessment report from a qualified EV technician.

- Repair invoices for all parts replaced or repaired.

- Photographs or videos of the damage.

Flow Chart of the EV Claim Process

The following flowchart illustrates the general steps involved in an EV claim process.

| Step | Action |

|---|---|

| 1 | Incident Report |

| 2 | Damage Assessment (EV Specialist) |

| 3 | Estimate Repair Costs |

| 4 | Parts Procurement (if necessary) |

| 5 | Repair (EV Specialist) |

| 6 | Final Inspection |

| 7 | Claim Settlement |

Insurance Providers and their Approaches

Insurance providers are increasingly adapting their strategies to address the unique characteristics of electric vehicles (EVs). This involves careful consideration of factors like vehicle technology, repair costs, and potential risks associated with new technologies. Understanding these strategies is crucial for EV owners to make informed decisions about insurance coverage.Different insurance providers employ various pricing models and coverage packages to cater to the evolving EV market.

These approaches are shaped by the specific risks and benefits associated with EVs, influencing the overall cost of insurance.

Pricing Strategies of EV Insurance Providers

Insurance companies employ diverse pricing methodologies for EV insurance. Some insurers utilize a tiered system, differentiating premiums based on factors like vehicle model, battery capacity, and charging infrastructure access. Others leverage data analytics to assess risk profiles, taking into account factors like driving habits and vehicle usage patterns. Furthermore, the level of safety features in the vehicle also significantly impacts the pricing.

Common Insurance Providers Offering EV Insurance

Several well-established insurance providers now offer EV-specific policies. These companies often have dedicated teams and resources focused on understanding the nuances of EV ownership. The most prominent include major national insurers and some smaller regional companies.

Factors Influencing Insurance Provider Decisions

Several key factors influence insurance provider decisions on EV policies. These include the availability and reliability of EV repair services, the frequency of EV-related claims, and the overall market penetration of EVs. Additionally, the cost of replacing or repairing EV components plays a significant role in determining premiums.

Comparison of Different Insurance Providers’ Approaches

Insurance providers differ in their approaches to EV insurance. Some providers offer comprehensive packages tailored to specific EV models, providing a detailed breakdown of coverage options. Others might prioritize a simpler, more standardized approach to EV insurance, potentially resulting in varying levels of coverage based on factors like the battery technology. Comparative analysis across providers can help EV owners find the most suitable policy.

Overview of EV Insurance Offerings from Specific Insurance Companies

Specific insurance companies have different strategies for EV insurance. Some companies might offer discounts for EVs with advanced safety features, while others might emphasize the importance of comprehensive coverage for battery-related issues. The specific coverage and pricing can vary substantially between providers, making thorough research critical for EV owners. Examples of such strategies are bundled EV insurance packages from some companies.

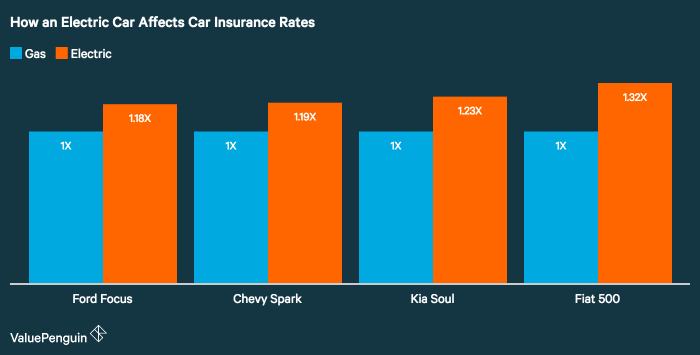

Safety Features and Insurance

Source: cloudinary.com

Electric vehicles (EVs) are increasingly incorporating sophisticated safety features, impacting insurance premiums. These advanced systems, often bundled with the vehicle’s price, can influence the perceived risk associated with owning an EV. Understanding how these features affect insurance costs is crucial for prospective EV owners.Safety features in EVs, from basic braking systems to advanced driver-assistance systems (ADAS), play a significant role in determining insurance premiums.

Insurance companies assess the risk associated with a vehicle based on its ability to mitigate potential accidents. Vehicles with more robust safety technology are generally considered lower-risk, leading to potentially lower insurance costs.

Impact of Safety Features on Insurance Premiums

Safety features in EVs are designed to enhance driver awareness and vehicle control. These features often include advanced braking systems, lane departure warnings, and automatic emergency braking. The presence and sophistication of these features directly affect the perception of risk held by insurance providers.

- Advanced Driver-Assistance Systems (ADAS): ADAS features, such as adaptive cruise control, lane-keeping assist, and automatic emergency braking, are increasingly common in EVs. These features can significantly reduce the risk of accidents, leading to lower insurance premiums for vehicles equipped with them. For instance, vehicles with automatic emergency braking systems have shown a demonstrably lower accident rate compared to vehicles without such features, which translates into lower insurance costs for the owners of the equipped vehicles.

- Level of Safety Technology: The level of safety technology integrated into an EV directly correlates with the insurance premium. Vehicles with a higher level of safety features, often bundled with more advanced ADAS, tend to receive lower premiums. A vehicle with features like surround-view cameras and 360-degree sensors, for example, might be assessed as lower risk, resulting in a more favorable insurance rate compared to a vehicle without these advanced safety features.

- Autonomous Driving Features: The integration of autonomous driving features in EVs is an evolving aspect. Vehicles with varying degrees of autonomy (e.g., Level 2, Level 3) are currently available. The introduction of fully autonomous driving capabilities is still in its early stages, and the impact on insurance rates is uncertain. Early studies, however, suggest that vehicles with greater levels of autonomy might receive lower insurance premiums due to their ability to mitigate certain accident scenarios.

Insurance companies are closely monitoring this emerging technology to accurately assess risk levels. However, it is important to note that vehicles with advanced autonomous driving features require thorough testing and validation before their safety benefits are fully understood by insurance companies.

Summary of Safety Features and Insurance Premiums

The table below illustrates the general impact of various safety features on insurance premiums. It is crucial to remember that this is a general guideline, and actual premiums can vary based on individual factors such as driving history, location, and vehicle model.

| Safety Feature | Impact on Insurance Premium |

|---|---|

| Basic braking systems | Minimal impact |

| Advanced Driver-Assistance Systems (ADAS) | Potentially significant decrease |

| High-level safety technology (e.g., multiple sensors, cameras) | Potentially significant decrease |

| Autonomous driving features (Level 2+) | Potentially moderate decrease, depending on the level and maturity of the technology |

Tips for Lowering Electric Car Insurance Costs

Electric vehicle (EV) insurance premiums can sometimes be higher than those for traditional gasoline-powered cars. However, several strategies can help reduce these costs. Proactive measures and informed choices can significantly impact the overall cost of insuring your EV.Understanding the factors influencing EV insurance premiums and implementing preventative measures can help drivers obtain more favorable rates. By proactively managing risk and showcasing responsible driving habits, EV owners can potentially secure lower insurance costs.

Safe Driving Practices

Maintaining a safe driving record is crucial for securing lower insurance premiums. Consistent adherence to traffic laws and safe driving habits demonstrates responsible ownership and reduces the likelihood of accidents. Insurance companies often reward drivers with clean driving records with reduced premiums.

- Avoid speeding and aggressive driving. These actions significantly increase the risk of accidents and lead to higher insurance premiums.

- Maintain a safe following distance to avoid rear-end collisions. Predictable driving contributes to safer roadways and often results in more favorable insurance rates.

- Regularly participate in defensive driving courses. These courses equip drivers with techniques to anticipate and react to potential hazards, ultimately reducing the risk of accidents.

Vehicle Maintenance and Security

Proper vehicle maintenance and security measures contribute to the safety and longevity of the EV, impacting insurance costs.

- Regularly schedule maintenance appointments. Following the manufacturer’s recommended maintenance schedule helps ensure the EV’s optimal performance and longevity. This proactive approach often translates into lower insurance premiums.

- Install advanced security features. Vehicle tracking systems and alarms deter theft and vandalism. This proactive approach demonstrates responsible ownership and often results in reduced insurance costs.

- Park in well-lit and secure areas. Parking in secure locations minimizes the risk of theft and vandalism, ultimately reducing the likelihood of claims and associated costs.

Insurance Provider Comparisons

Comparing quotes from different insurance providers is essential for obtaining the best possible rates. A variety of providers may offer different packages and premiums.

- Seek quotes from multiple insurance providers. This allows for comparison shopping and identification of the most suitable coverage at the most competitive rates.

- Review different coverage options. Understanding various coverage packages allows for selection of the optimal coverage that meets individual needs and budget constraints.

- Consider bundling insurance policies. Bundling policies, such as auto and home insurance, can potentially result in discounted rates.

Insurance Discounts

Leveraging available insurance discounts can substantially reduce premiums. Various factors can qualify for discounts, and these can significantly impact the overall cost.

- Consider available discounts. Many insurance providers offer discounts for safe driving records, anti-theft devices, and vehicle features.

- Review discount eligibility. Understanding the criteria for each discount ensures that drivers can maximize savings.

- Maintain a clean driving record. This is a critical factor in securing favorable insurance rates and avoiding potential premium increases.

Future Trends in Electric Vehicle Insurance: Electric Car Insurance Costs And Factors

The electric vehicle (EV) insurance market is rapidly evolving, driven by technological advancements and changing consumer behavior. Predicting future trends requires considering the interplay of emerging technologies, safety features, and evolving claims patterns. This section examines anticipated developments in EV insurance, focusing on the impact of autonomous driving, telematics, and new technologies on cost and availability.

Autonomous Driving and Insurance

Autonomous driving technologies are poised to significantly reshape the EV insurance landscape. As vehicles become increasingly automated, the role of human error in accidents will diminish. Insurance companies will need to adjust their risk assessment models to reflect this change, potentially leading to a re-evaluation of liability in accidents involving fully autonomous vehicles. For instance, if a self-driving car is involved in an accident, determining fault and assigning responsibility may require a reassessment of current legal frameworks and insurance policies.

Evolving Role of Telematics

Telematics data, collected from in-vehicle sensors, is becoming increasingly crucial in assessing risk and determining insurance premiums. For EVs, telematics can provide valuable data on driving patterns, charging habits, and vehicle maintenance. This data allows insurers to tailor premiums based on individual driving behavior and vehicle usage. For example, drivers with a proven history of safe driving habits, demonstrated through telematics data, may qualify for lower insurance premiums.

Impact of New Technologies on EV Insurance Costs and Availability

New technologies, such as advanced driver-assistance systems (ADAS) and battery management systems, will likely influence the cost and availability of EV insurance. The increased safety features of these vehicles could lead to lower premiums for drivers who utilize them effectively. Conversely, the more complex technology could introduce new areas of risk, potentially requiring more extensive coverage and impacting insurance pricing.

Furthermore, the unique challenges of EV battery failures could introduce specific coverage requirements, affecting availability and pricing for some insurance policies.

Expected Changes in the EV Insurance Industry

The EV insurance market is expected to undergo substantial transformation. Insurance companies will need to adapt their risk assessment models, incorporating data from telematics and autonomous driving systems. Premiums may vary significantly based on individual driving behavior, vehicle usage, and the presence of advanced safety features. Moreover, the increasing sophistication of EV technology will demand new coverage options for battery failures, potentially leading to specialized insurance products.

Ultimately, a more data-driven and technology-focused approach to EV insurance is expected.

Outcome Summary

In conclusion, electric car insurance costs and factors are multifaceted, influenced by a range of variables unique to EVs. From battery coverage to safety features, understanding these aspects is critical for informed decision-making. The evolving landscape of the EV insurance market presents both challenges and opportunities. As technology advances, the insurance industry must adapt to provide comprehensive coverage for these innovative vehicles.

By understanding the current and future trends, EV owners can make informed choices about insurance coverage and premiums.

Post Comment