Rise and Fall of Dot-Com Bubble A Detailed Look

Rise and fall of dot com bubble – The rise and fall of the dot-com bubble was a period of intense speculation, rapid growth, and ultimately, a dramatic correction. This period saw the explosive emergence of internet-based companies, fueled by venture capital and media hype. Early indicators of this boom included the rapid expansion of internet services, attracting massive investments and generating enormous expectations. The subsequent crash exposed vulnerabilities in inflated valuations and unsustainable business models, leaving lasting implications for the tech industry and the broader economy.

This exploration delves into the factors that propelled the initial rise, examining the strategies employed by companies, the role of investor psychology, and the interconnectedness of various dot-com ventures. The analysis will also trace the eventual decline, highlighting the economic pressures that led to the bust, and outlining the key lessons learned and impacts on the broader economy and investment strategies.

Specific case studies of notable companies will illustrate the dynamics of this period, while visual representations will offer a comprehensive understanding of the bubble’s trajectory.

Early Signs and Catalysts

The late 1990s witnessed a dramatic surge in internet-based businesses, creating a frenzied atmosphere of investment and innovation. This period, often referred to as the dot-com boom, was characterized by rapid expansion, fueled by optimistic predictions about the future of e-commerce and online services. Early indicators painted a picture of unprecedented growth potential, attracting significant venture capital and fueling an industry-wide frenzy.The burgeoning internet infrastructure, coupled with the promise of limitless opportunities, created a potent cocktail for rapid expansion.

Investors, often with limited prior experience in the digital space, were eager to capitalize on the perceived gold rush. This environment was marked by substantial risk-taking, as companies raced to establish a foothold in the rapidly evolving digital landscape.

Early Indicators of the Dot-Com Boom

The early indicators of the dot-com boom were multifaceted, encompassing technological advancements, market enthusiasm, and investor fervor. The development of faster internet connections, more user-friendly web browsers, and the rise of online shopping platforms all contributed to the burgeoning interest in e-commerce. The growing number of internet users, coupled with the increasing accessibility of online services, demonstrated the potential for significant market expansion.

Factors Fueling Rapid Expansion

Several factors propelled the rapid expansion of internet-based companies. Firstly, the belief in the transformative power of the internet fueled an unprecedented surge in optimism and investment. The perceived potential of e-commerce, online services, and digital marketing created a sense of limitless opportunity, attracting both individual investors and large corporations. Secondly, the availability of venture capital played a crucial role.

A flood of capital poured into promising internet companies, enabling them to expand rapidly and aggressively. Thirdly, the emergence of new business models, such as online auctions and virtual marketplaces, presented novel ways to conduct commerce and engage consumers.

Examples of Early Venture Capital Investments

Numerous venture capital firms invested heavily in early dot-com companies, recognizing the potential for high returns. One notable example is the investment in companies like Amazon, which was initially perceived as a disruptive online bookstore, or eBay, which revolutionized online auctions. These investments had a significant impact, not only by providing capital but also by attracting further investment and talent.

They also fostered competition and innovation in the rapidly growing market.

Comparison of Early Dot-com Companies with Traditional Businesses

| Characteristic | Early Dot-com Companies | Traditional Businesses |

|---|---|---|

| Business Model | Often focused on online sales, digital services, and e-commerce | Primarily reliant on physical stores, manufacturing, or traditional distribution channels |

| Operating Costs | Potentially lower operating costs compared to traditional businesses due to reduced need for physical infrastructure | Higher operating costs associated with physical space, inventory management, and distribution networks |

| Growth Potential | High potential for rapid growth and global reach | Growth often limited by physical constraints and existing market share |

| Revenue Generation | Revenue generation often based on subscriptions, sales, and advertising | Revenue generated through sales of goods or services |

| Funding Sources | Heavily reliant on venture capital and initial public offerings (IPOs) | Typically rely on debt financing, retained earnings, and bank loans |

The Rise of Hype and Speculation: Rise And Fall Of Dot Com Bubble

The dot-com boom wasn’t solely driven by technological innovation; a potent cocktail of media hype, investor psychology, and aggressive capital-raising tactics fueled the rapid ascent of internet companies. The narrative spun around the internet’s transformative potential, creating a fervent belief in its boundless future. This atmosphere fostered an environment ripe for speculative investment, leading to valuations that often detached from reality.The media played a significant role in amplifying this optimism.

Extensive coverage, often lacking critical analysis, painted a picture of inevitable success for internet ventures. This pervasive sense of excitement and inevitability influenced investor sentiment, driving up stock prices well beyond justifiable levels. The focus often shifted from fundamental business metrics to the sheer possibility of future growth, creating a bubble of speculation.

Media Coverage and Optimism

News outlets, eager to capitalize on the emerging internet phenomenon, frequently reported on the rapid growth and potential of internet companies. This often led to an overly positive portrayal, emphasizing the success stories and overlooking potential risks or challenges. This kind of coverage created a self-reinforcing cycle, where positive news stories further fueled investor enthusiasm, leading to even more media attention.

This dynamic made it difficult for investors to assess the true value of these companies objectively.

Investor Psychology and Valuations

Investor psychology played a crucial role in the inflated valuations of internet companies. The belief in the transformative power of the internet and the potential for extraordinary returns created a climate of exuberance. Many investors, fueled by the apparent success of early internet pioneers, were drawn to the sector, regardless of the underlying business fundamentals. This speculative fervor drove valuations far beyond what traditional valuation models might have predicted.

Investors were often less concerned with profitability and more focused on the perceived growth potential. The irrational exuberance was a major contributing factor to the unsustainable bubble.

Methods for Raising Capital

Internet companies employed various methods to raise capital during the boom. Initial Public Offerings (IPOs) were frequently used, with companies often seeking massive sums of money to fuel expansion and product development. Venture capital funding also played a significant role, with investors eager to capitalize on the perceived potential of the sector. In some cases, companies used the rapid rise in stock prices to issue more stock, further fueling the growth in market capitalization.

The ease with which companies could raise capital, combined with investor enthusiasm, made it difficult for the market to accurately reflect the true value of these companies.

Rapid Stock Price Increase of Prominent Dot-Com Companies

| Company | Initial Public Offering (IPO) Price | Peak Stock Price | Date of Peak Stock Price |

|---|---|---|---|

| Amazon.com | $18 | $118.52 | May 10, 2000 |

| Yahoo! | $13 | $127.20 | March 22, 2000 |

| Google (formerly Google Inc.) | N/A (IPO was in 2004) | N/A (IPO was in 2004) | N/A (IPO was in 2004) |

| eBay | $18 | $120.00 | April 27, 2000 |

The table above provides a glimpse into the dramatic increase in stock prices for some prominent dot-com companies. Note that these are just a few examples; many other internet companies saw similar, if not more substantial, increases. The sheer magnitude of these price increases reflects the significant role of hype and speculation in driving the dot-com bubble. These figures clearly illustrate the extent of the market’s optimism and detachment from reality.

The Tech Companies and their Strategies

The dot-com boom witnessed a diverse array of online businesses, each vying for market share and investor attention. Understanding the differing approaches of these companies is crucial to comprehending the bubble’s dynamics and eventual collapse. Different business models, customer acquisition strategies, and technological advancements shaped the landscape, ultimately leading to a period of rapid growth followed by a sharp downturn.The varying business models of dot-com companies reflected the nascent nature of the internet economy.

Some companies pursued a direct-to-consumer approach, while others focused on advertising revenue or partnerships. A critical aspect of their success relied on attracting both customers and investors, a challenge that proved difficult to maintain during the bubble’s peak. The relentless pursuit of innovation, driven by the desire to create groundbreaking online services, was a significant factor in the initial enthusiasm and subsequent crash.

Business Models of Dot-Com Companies

The multitude of business models employed during the dot-com era reflects the diverse applications of internet technology. Companies focused on e-commerce, online marketplaces, and portal services presented varied revenue streams. E-commerce companies like Amazon focused on selling goods online, while portals like Yahoo! offered a central hub for information and services. Others, such as online travel agents and financial services providers, developed unique approaches to capitalize on the burgeoning online marketplace.

- E-commerce: Companies like Amazon leveraged online platforms to sell products directly to consumers. Their strategies emphasized convenience, wide selection, and competitive pricing, leading to rapid growth in the early years of the dot-com boom. This strategy relied heavily on building trust and establishing a reputation for reliable service.

- Online Marketplaces: Platforms like eBay connected buyers and sellers, fostering a dynamic online marketplace. The emphasis was on creating a user-friendly interface and facilitating secure transactions. The success of these platforms hinged on attracting a large and active community of users.

- Portal Services: Companies like Yahoo! and AOL acted as gateways to the internet, offering access to news, email, and other online services. Their revenue model primarily relied on advertising, which presented an opportunity to leverage a large user base for revenue generation.

- Content Providers: Companies focused on creating and distributing digital content, like news, entertainment, or educational resources, often incorporated a subscription model. The focus was on delivering high-quality content to attract a loyal subscriber base.

Key Strategies for Attracting Customers and Investors

Dot-com companies employed various strategies to capture the attention of both consumers and investors. These strategies often revolved around creating hype, showcasing innovative features, and highlighting potential for exponential growth. The rapid expansion of the internet infrastructure and the potential for global reach presented immense opportunities for these companies.

- Aggressive Marketing Campaigns: Companies frequently utilized aggressive marketing strategies to generate excitement and awareness about their products and services. This included extensive advertising across various media platforms, emphasizing the uniqueness and potential of their offerings. Examples included highly visible advertisements and partnerships with popular media outlets.

- Investor Relations and Public Image: Companies actively cultivated a positive image and engaged in extensive investor relations to secure funding. Highlighting potential for high growth and innovative technologies was a primary focus. This included providing detailed presentations and engaging in public forums.

- Early Adopter Programs and Free Trials: Companies often offered early adopter programs and free trials to attract a loyal customer base and demonstrate the value of their services. This helped to generate excitement and create a sense of community among users.

Innovations and Advancements Driving Growth

The rise of online services was significantly influenced by innovations in internet technology. These advancements fostered the rapid growth of online services, attracting both users and investors. The ease of access to information and the ability to conduct transactions online revolutionized various industries.

- Advancements in Web Technologies: Improvements in web technologies like HTML and JavaScript enabled the development of dynamic and interactive websites. This enhanced user experience and fostered innovation in various online services. More advanced and interactive web pages could now be developed, leading to increased user engagement.

- Growth of Broadband Internet: The expansion of broadband internet access significantly improved the speed and reliability of online services, allowing for more sophisticated applications and content delivery. This was crucial for the widespread adoption of video streaming, online gaming, and other bandwidth-intensive services.

- Rise of E-commerce Platforms: The development of secure online payment systems and reliable shipping infrastructure enabled the growth of e-commerce. This facilitated the purchase and delivery of goods over the internet, transforming the retail landscape.

Evolution of Key Internet Technologies

| Technology | Early Stage (Early 1990s) | Mid-Stage (Late 1990s) | Late Stage (Early 2000s) |

|---|---|---|---|

| Web Browsers | Basic text-based browsers | Graphical browsers with multimedia capabilities | Sophisticated browsers with enhanced security and features |

| Internet Connectivity | Dial-up modems | ISDN and early broadband | High-speed broadband and wireless connectivity |

| Web Servers | Simple server configurations | More powerful and scalable servers | Cloud-based servers and distributed architectures |

| Programming Languages | Early scripting languages | Increased use of JavaScript and server-side languages | Sophisticated frameworks and languages |

The Bubble’s Burst

Source: thestreet.com

The frenzied growth of the dot-com era ultimately couldn’t sustain itself. A cascade of factors, stemming from both internal market pressures and external economic realities, contributed to the inevitable bursting of the bubble. The euphoria of rapid expansion gave way to harsh realities as investors faced the harsh truth about the viability of many internet-based companies.The initial exuberance of the dot-com boom masked significant underlying weaknesses in many companies’ business models.

Investors, blinded by the promise of instant riches, often overlooked critical aspects such as revenue generation, profitability, and long-term sustainability. The subsequent market correction served as a harsh reminder that financial success requires more than just a catchy name and a promising concept.

Factors Contributing to the Decline

The collapse of the dot-com bubble wasn’t a single event but rather a confluence of factors. Overvaluation of internet stocks, coupled with a lack of concrete revenue streams, created a fragile foundation for the entire market. Investors began to question the long-term viability of many companies, leading to a sharp decline in valuations. The exuberance of the market was fueled by speculation, not sound fundamentals.

Economic Pressures

Several economic pressures contributed to the eventual decline. The rising interest rates, implemented by the Federal Reserve to combat inflation, made borrowing more expensive. This directly impacted companies that heavily relied on capital for expansion and operations. Furthermore, the slowing economy reduced consumer spending, impacting the demand for many internet-based services and products. The reality of the economic climate became more apparent as the market cooled.

Consequences of Inflated Valuations

Inflated valuations, driven by speculation and a lack of realistic assessment, led to unsustainable business models. Many companies, focused on rapid growth rather than profitability, incurred substantial losses. The unsustainable growth patterns were a clear sign of the underlying problems. Investors lost substantial amounts of capital, highlighting the dangers of chasing speculative trends without a thorough understanding of the underlying business.

Decline in Stock Prices

The collapse was evident in the plummeting stock prices of numerous dot-com companies. The following table illustrates the dramatic decline experienced by several notable firms. It’s crucial to understand that the valuations shown were highly volatile and often detached from actual business performance.

| Company | Initial Stock Price (Approximate) | Price After Bubble Burst (Approximate) |

|---|---|---|

| Amazon.com | $110 | $10 |

| Yahoo! | $120 | $20 |

| Pets.com | $450 | $1 |

| Webvan | $40 | $0.50 |

| EToys | $60 | $2 |

Lessons Learned and Impacts

The dot-com bubble’s spectacular rise and subsequent crash had profound and lasting effects on the global economy, particularly on venture capital, investment strategies, and the growth of specific industries. This period serves as a crucial case study for understanding the dynamics of market exuberance, the importance of realistic valuations, and the long-term consequences of unchecked speculation.The dot-com bust underscored the need for a more nuanced and critical approach to evaluating the viability and potential of new technologies and businesses.

It demonstrated that rapid growth fueled by hype and speculation can be unsustainable, leading to severe market corrections. The lessons learned from this period continue to resonate today, reminding investors and entrepreneurs of the importance of careful analysis, thorough due diligence, and long-term vision.

Long-Term Implications on the Broader Economy

The dot-com bust significantly impacted the broader economy by triggering a wave of bankruptcies and layoffs, particularly in the technology sector. This led to a period of economic uncertainty and a reassessment of risk tolerance in various investment avenues. The downturn also resulted in a tightening of credit markets and a cautious approach to investing in high-growth startups.

Furthermore, the bust impacted consumer confidence, which subsequently affected overall economic activity.

Key Lessons Learned from the Dot-Com Bubble

Several key lessons emerged from the dot-com bubble. First, the importance of realistic valuations and fundamental analysis became paramount. Second, the need for a more sustainable and less speculative approach to business models was recognized. Finally, the fragility of market bubbles and the necessity of cautious risk management strategies were highlighted.

Impact on Venture Capital and Investment Strategies

The dot-com bust profoundly reshaped venture capital and investment strategies. Investors learned that focusing solely on rapid growth and market capitalization was insufficient. They started emphasizing a more balanced approach that included a careful assessment of a company’s business model, revenue potential, and long-term sustainability. This shift resulted in a more rigorous due diligence process and a greater emphasis on fundamental analysis.

Examples of this include a move away from purely speculative investments to ones with more tangible revenue projections. Further, investors began demanding more concrete evidence of revenue generation and profitability from startups, leading to a more cautious and discerning approach to venture capital.

Evolution of Business Models and Investment Strategies Post-Bust

Following the dot-com crash, business models evolved to incorporate more sustainable strategies. Companies began to prioritize profitability and revenue generation over rapid expansion and market share gains. Furthermore, there was a shift toward more practical and tangible business models, which focused on addressing real customer needs and generating predictable revenue streams. In the realm of investment strategies, a greater emphasis was placed on fundamental analysis and a more balanced risk tolerance.

Investors were more discerning in their evaluations, demanding proof of revenue generation and a clear path to profitability.

Impact on the Growth of Specific Industries

The dot-com bust had varying impacts on different industries. While some, like e-commerce, emerged stronger and more resilient, others, like online advertising and portal companies, experienced significant setbacks. The rapid growth of e-commerce was tempered, and the need for more mature and profitable business models became apparent. The initial excitement and hype surrounding the internet’s potential impact on various sectors were tempered, and a more practical approach to implementation became crucial.

The dot-com bust prompted a re-evaluation of existing business models and the need for demonstrable profitability in the sector. For instance, companies that had focused primarily on rapid expansion and market capitalization, without a clear path to profitability, faced challenges.

Illustrative Case Studies

The dot-com bubble witnessed the meteoric rise and spectacular fall of numerous companies. Analyzing these cases provides valuable insights into the factors that fueled the hype, the vulnerabilities inherent in rapid growth, and the consequences of speculative investment. Examining specific companies allows a deeper understanding of the broader trends and lessons learned from this period.

The Rise and Fall of Pets.com

Pets.com, a pioneering online pet supply retailer, epitomized the dot-com boom’s allure and subsequent disillusionment. Launched with significant fanfare and substantial funding, the company aimed to revolutionize pet product distribution. Its innovative strategies included a comprehensive online store, a focus on direct-to-consumer sales, and the ambition to achieve a significant market share.

- Pets.com’s Strategies and Innovations: The company employed a multi-faceted approach, including an expansive online catalog, interactive features, and a focus on customer service. Their initial strategies involved a large investment in marketing and infrastructure, aiming to quickly establish a customer base. They also leveraged the growing popularity of e-commerce.

- Factors Contributing to Success and Failure: While Pets.com successfully capitalized on the emerging e-commerce trend, its failure was rooted in several key factors. Overly ambitious projections and unsustainable business models were prominent issues. The company failed to adequately address crucial logistical challenges, particularly in warehousing and shipping. Furthermore, the company’s focus on rapid expansion outpaced its ability to manage operations and generate profit.

Poor management and a lack of focus on profitability contributed significantly to the company’s demise.

- Impact of the Dot-Com Bust: The burst of the dot-com bubble had a devastating impact on Pets.com. The company’s valuation plummeted, and investors lost significant sums. The lack of profitability and the inability to adapt to changing market conditions led to the company’s eventual bankruptcy.

Comparative Analysis of Dot-Com Companies, Rise and fall of dot com bubble

This table provides a concise comparison of the rise and fall of several prominent dot-com companies. It highlights the varying strategies, the degree of success, and the eventual impact of the dot-com bust.

| Company | Strategies & Innovations | Factors Contributing to Success/Failure | Impact of the Dot-Com Bust |

|---|---|---|---|

| Pets.com | Extensive online catalog, interactive features, customer service focus | Ambitious projections, unsustainable business model, logistical challenges, poor management | Valuation plummet, investor losses, bankruptcy |

| Webvan | Online grocery delivery service, large-scale infrastructure | High operational costs, inaccurate demand forecasts, lack of profitability | Financial distress, bankruptcy |

| Boo.com | Global e-commerce platform, focus on international expansion | Poor logistics, unsustainable expansion, weak brand recognition | Financial difficulties, closure |

| eToys | Online toy retailer | High inventory costs, ineffective supply chain, rapid growth | Significant financial losses, bankruptcy |

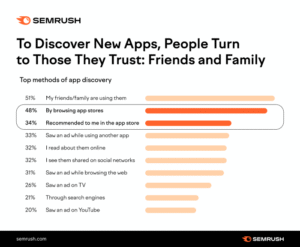

Visual Representation of the Bubble

The rise and fall of the dot-com bubble was a dramatic period in internet history, marked by rapid growth, exuberant speculation, and ultimately, a spectacular crash. Visual representations can help us understand the dynamics of this period, from the initial surge in valuations to the eventual correction. These visual tools reveal the intertwined factors that fueled the bubble and the subsequent disillusionment.

Stock Valuation Fluctuation

A crucial aspect of understanding the dot-com bubble is its reflection in the fluctuating valuations of internet stocks. A line graph, plotting the average market capitalization of a selection of prominent dot-com companies over time, would effectively illustrate this. The upward trajectory would show the rapid ascent of valuations, peaking at the bubble’s height, followed by a sharp decline as the bubble burst.

Superimposed data points representing major events, like IPOs or significant news impacting specific companies, would enhance the narrative. For example, the initial public offering (IPO) of Amazon in 1997, followed by substantial stock price increases, would be prominently displayed.

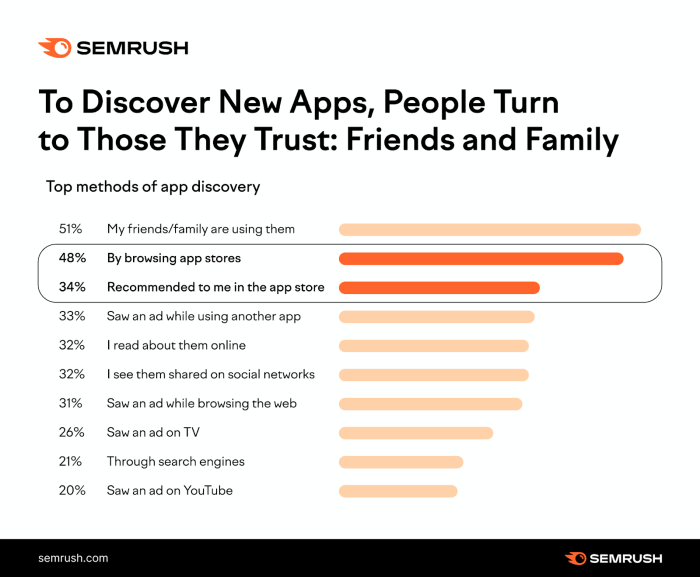

Internet Adoption Rates

The increasing adoption of the internet played a significant role in the bubble’s development. A bar chart showcasing the evolution of internet user numbers and penetration rates (percentage of population using the internet) would clearly demonstrate this trend. The chart would track these figures over the period, highlighting the accelerating growth during the bubble’s rise and the subsequent, though less dramatic, continuation of growth.

Relationship Between Internet Usage and Economic Growth

The rise of internet usage during this period is inextricably linked to economic growth. A scatter plot, correlating internet user numbers with economic indicators such as GDP growth or consumer spending, would illustrate this relationship. The plot would show a positive correlation between internet usage and economic growth during the bubble’s boom.

Impact of Technological Advancements

Technological advancements were crucial to the rapid growth of the internet. A table would demonstrate how specific innovations, such as improved bandwidth, faster processors, and the development of user-friendly interfaces, contributed to increased internet usage and valuations. For example, the introduction of broadband internet connections would be listed as a catalyst for increased usage and the rise of online commerce.

Interconnectedness of Dot-com Companies

A network diagram or a Sankey diagram could effectively represent the interconnectedness of various dot-com companies. Nodes would represent different companies, and lines would indicate their relationships, such as partnerships, investments, or joint ventures. This visual representation would reveal the intricate web of connections that characterized the dot-com ecosystem and provide a clear picture of how these companies were intertwined during the bubble period.

For instance, the diagram would show the alliances between companies to create online marketplaces or to provide services to each other.

Outcome Summary

The dot-com bubble, a period of remarkable innovation and feverish speculation, ultimately underscored the importance of sound business practices, realistic valuations, and a nuanced understanding of market forces. The rise and fall serve as a valuable case study for understanding the cycles of economic growth and correction. Lessons learned during this period continue to resonate in modern business practices and investment strategies, providing a framework for navigating the complexities of the digital age.

Post Comment