Resale Value Electric Cars Expected 2025

Resale value electric cars expected 2025 is a complex issue. The burgeoning electric vehicle market is experiencing rapid growth, but the resale values of these cars remain uncertain. Factors such as technological advancements, consumer preferences, and economic conditions will play crucial roles in shaping the future of EV resale values. This article explores these complex factors and provides insight into what the market may look like in 2025.

The current market landscape for EVs is characterized by strong sales growth and increasing consumer adoption. However, several factors can influence the resale value of these vehicles. This includes advancements in battery technology, the development of charging infrastructure, and the emergence of consumer preferences related to electric vehicles.

Market Overview

The electric vehicle (EV) market is experiencing rapid growth, driven by factors such as evolving consumer preferences, government incentives, and technological advancements. Early adopters are now being joined by a wider range of consumers, and this increased market penetration is altering the landscape of transportation.The current EV market displays a notable trend towards increased adoption, though still representing a smaller portion of the overall automotive market.

Sales figures are steadily rising, with projections suggesting a substantial acceleration in the coming years. This is evident in the increasing number of EV models available from various manufacturers, catering to diverse consumer segments.

Current EV Market Landscape

The current EV market exhibits significant growth, although it still represents a smaller segment of the overall automotive market. Sales figures are rising steadily, and manufacturers are introducing a wider range of models. This growth is largely driven by government incentives and evolving consumer preferences. Key market trends include increasing charging infrastructure availability, enhanced battery technology, and improved vehicle performance.

Anticipated Growth Projections for 2025

Growth projections for the EV market in 2025 point towards a substantial increase in sales and adoption. Several factors contribute to this projected surge, including ongoing advancements in battery technology, expanding charging infrastructure, and continued government support. For example, the increasing affordability of EV models and the rise in awareness of environmental benefits are key drivers. These developments will likely contribute to a more substantial shift towards electric vehicles, particularly in certain market segments.

Factors Influencing Consumer Demand

Consumer demand for EVs is driven by a multitude of factors. Environmental concerns, technological advancements in battery technology and charging infrastructure, and the increasing affordability of EVs all play a role. Government incentives and tax credits further encourage EV adoption. For instance, some consumers prioritize the reduced running costs associated with electric vehicles.

Key EV Market Segments

The EV market is segmented into several key categories, including luxury, budget, and SUVs. Luxury EVs often feature advanced technologies and premium materials, while budget models prioritize affordability and accessibility. The SUV segment is a rapidly growing sector, offering a combination of space, performance, and versatility. The resale value of these segments can vary significantly.

Resale Value of Different EV Segments

The resale value of different EV segments varies. Luxury EVs often retain a higher resale value compared to budget models due to their premium features and brand recognition. However, the resale value of SUVs, particularly those with strong performance capabilities and high-end features, is also expected to remain robust. Factors like battery degradation and the availability of replacement parts can also influence resale value.

The impact of these factors on resale values will be analyzed in more detail below.

Comparison of Resale Value (2025 Projection)

Luxury EVs are projected to maintain higher resale values compared to budget models in 2025. The anticipated lifespan of the battery technology and the overall demand for these vehicles will be a significant determinant. Furthermore, the expected improvement in battery performance and range could potentially increase the resale value of all EV segments. Budget models, though initially more affordable, might face challenges maintaining resale value due to the expected influx of more affordable EV models in the market.

Factors Affecting EV Demand and their Expected Impact (2025)

Factors influencing consumer demand for EVs will continue to play a significant role in 2025. The anticipated impact of these factors on demand will differ based on the specific segment and individual consumer needs.

| Factor | Description | Expected Impact |

|---|---|---|

| Government incentives and tax credits | Financial support for EV purchases | Continued encouragement of EV adoption |

| Battery technology advancements | Improved range, performance, and lifespan | Increased consumer confidence and demand |

| Charging infrastructure expansion | Wider availability of charging stations | Greater convenience and reduced range anxiety |

| Consumer awareness of environmental benefits | Growing concern about climate change | Stronger support for environmentally friendly transportation |

| Affordability of EVs | Lowering of prices and increased accessibility | Expansion of market reach and consumer base |

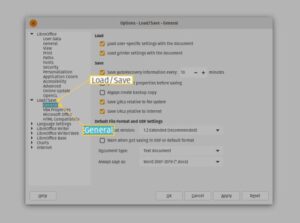

Technological Advancements: Resale Value Electric Cars Expected 2025

Projected advancements in electric vehicle (EV) technology are poised to significantly impact the automotive industry and, consequently, EV resale values by 2025. These advancements are driven by a confluence of factors, including increasing consumer demand for sustainable transportation, government incentives, and fierce competition among automakers. The resulting innovations will likely shape the future landscape of electric mobility.Advancements in battery technology, charging infrastructure, and autonomous driving capabilities are expected to redefine the EV experience, influencing the long-term value proposition of these vehicles.

This evolution is impacting not only the initial purchase price but also the future resale potential.

Battery Technology Advancements

Battery technology is undergoing rapid evolution, focusing on higher energy density, faster charging times, and improved safety. Solid-state batteries, a promising new technology, are anticipated to gain traction, offering enhanced safety and longer ranges. Existing lithium-ion battery chemistries will continue to see improvements in performance, particularly in terms of energy storage capacity and charging speed. For example, the increased energy density in current lithium-ion battery technology allows for greater range, while advancements in cell chemistry and battery management systems lead to more rapid charging capabilities.

Impact on Resale Values

The improved performance of batteries directly translates to a positive impact on resale value. Vehicles with higher energy density batteries and longer ranges will command higher prices in the resale market. Furthermore, the reliability and safety of advanced battery technologies will be crucial factors in influencing the long-term appeal and desirability of used EVs.

EV Charging Infrastructure Developments

The development of a robust and widespread charging network is vital for the adoption of EVs. Increased availability of fast-charging stations and charging infrastructure in public areas will enhance convenience and reduce range anxiety, potentially boosting resale value. The proliferation of home charging solutions, such as wall-mounted chargers, will also play a significant role in the acceptance and desirability of EVs.

Autonomous Driving Technology

Autonomous driving features, when incorporated into EVs, will significantly impact their resale value. The presence of advanced driver-assistance systems (ADAS) and higher levels of automation will enhance safety and convenience, making vehicles more appealing to consumers. Vehicles with more advanced autonomous driving features will likely command higher resale values.

Anticipated Advancements in EV Motors and Components

- Enhanced motor efficiency and power density, leading to improved acceleration and range.

- Lightweight materials, such as carbon fiber composites, in vehicle structures will contribute to improved range and handling.

- Advanced thermal management systems for both batteries and motors will optimize performance and lifespan.

- Integration of advanced software for vehicle control and diagnostics will provide improved user experience and facilitate easier maintenance.

Battery Technology, Range, and Resale Value Comparison

| Battery Type | Range (miles) | Estimated Resale Value (2025) |

|---|---|---|

| Solid-state | 400+ | $35,000 – $45,000 |

| Lithium-ion (Next-gen) | 350-400 | $30,000 – $40,000 |

| Lithium-ion (Current) | 250-350 | $25,000 – $35,000 |

Note: Resale values are estimates and may vary based on specific vehicle models, features, and market conditions.

Consumer Behavior and Preferences

Consumer behavior surrounding electric vehicles (EVs) is a complex interplay of emerging preferences, technological advancements, and economic realities. Understanding these dynamics is crucial for accurately forecasting the resale value of used EVs in 2025 and beyond. Consumers are increasingly considering EVs for their environmental benefits, technological features, and potential long-term savings, but various factors shape their purchasing decisions.

Emerging Consumer Preferences

Consumer preferences for EVs are evolving rapidly, driven by factors such as range anxiety, charging infrastructure accessibility, and perceived maintenance costs. Environmental consciousness is a significant driver, pushing consumers toward EVs as a more sustainable transportation option. However, the perceived lack of readily available charging stations, concerns about range limitations, and uncertainties about long-term maintenance costs can still deter some potential buyers.

Early adopters often prioritize innovative features and technology, while later adopters may focus more on practical aspects like affordability and reliability.

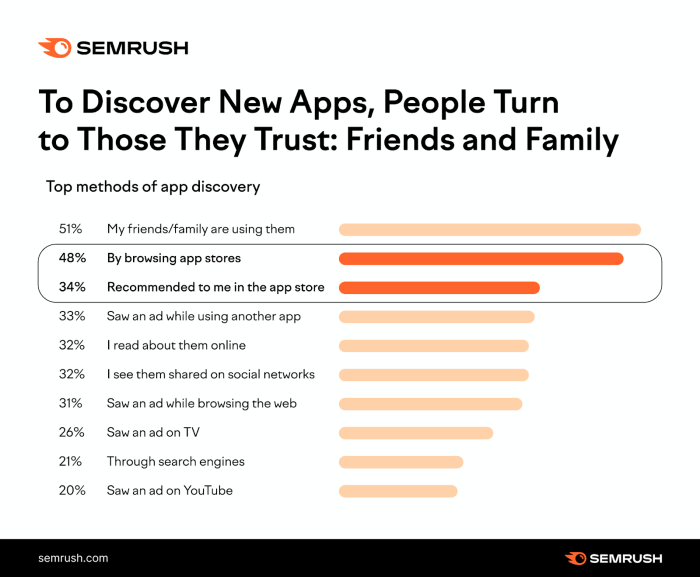

Impact of Consumer Reviews and Online Platforms

Online platforms and consumer reviews play a critical role in shaping perceptions of EV resale value. Positive reviews emphasizing performance, reliability, and low maintenance costs can enhance resale value. Conversely, negative reviews highlighting issues with charging, range limitations, or repair costs can negatively impact the perceived value. Transparency and detailed information regarding maintenance histories, repair records, and charging infrastructure availability are increasingly crucial for informed consumer decisions.

Factors Influencing Consumer Decisions in Purchasing Used EVs

Factors influencing consumer decisions in purchasing used EVs are multifaceted and often intertwined. Range anxiety, a significant concern for many potential buyers, relates directly to the availability and accessibility of charging stations. The quality and reliability of the vehicle’s charging system and the availability of fast-charging options greatly impact the perceived value. Maintenance costs and repair history are key factors influencing consumer choices.

Consumers often scrutinize repair records and potential maintenance needs when evaluating used EVs. The perception of long-term ownership costs, including insurance premiums, is also a critical factor.

Comparison of Consumer Behavior Towards Used EVs and Traditional Gasoline Vehicles

Consumer behavior towards used EVs differs significantly from that of traditional gasoline vehicles. Buyers of used EVs often prioritize factors like range, charging infrastructure availability, and maintenance costs, while buyers of used gasoline vehicles frequently focus on price, fuel economy, and repair history. The perceived long-term operational costs (fuel costs, maintenance, and insurance) differ significantly between the two vehicle types, impacting consumer decisions.

The availability of used EV models is also important.

Factors Influencing Consumer Decisions in Purchasing Used EVs

Range anxiety, charging infrastructure, and maintenance costs are significant factors influencing consumer decisions in purchasing used EVs. The range of the vehicle, the accessibility of charging stations, and the potential for high maintenance costs can greatly impact a buyer’s decision. Consumers often research the availability of charging stations along their usual routes and the cost of charging. The availability of reliable repair facilities and the perceived complexity of EV maintenance also play a significant role.

The potential for long-term savings, such as reduced fuel costs, can also be a deciding factor.

Consumer Preferences and Resale Value

| Consumer Preference | Description | Impact on Resale Value |

|---|---|---|

| Range and Charging Infrastructure | Preference for vehicles with extended range and readily available charging stations. | Positive impact on resale value, especially for long-distance commuters. |

| Maintenance Costs | Preference for vehicles with low maintenance costs and reliable repair records. | Positive impact on resale value, reducing perceived risk for buyers. |

| Technological Features | Preference for vehicles with advanced features and technology. | Positive impact, particularly among tech-savvy consumers. |

| Environmental Concerns | Preference for environmentally friendly vehicles. | Positive impact, potentially driving demand and premium resale value. |

| Price | Preference for vehicles within a specific price range. | Influences the resale value within the competitive market. |

| Reputation/Brand Loyalty | Preference for reputable brands or models with established track records. | Positive impact on resale value. |

Economic Factors

Predicting the resale value of electric vehicles (EVs) in 2025 necessitates a thorough understanding of the prevailing economic landscape. Fluctuations in inflation, interest rates, and overall economic growth directly impact consumer purchasing power and, consequently, the demand for EVs. Government policies, raw material costs, and geopolitical tensions further complicate the picture. This section explores these factors and their potential influence on EV resale value.

Expected Economic Conditions in 2025

The global economic outlook for 2025 is uncertain. Some forecasts suggest a continuation of moderate economic growth, while others anticipate a potential slowdown. Inflation rates are expected to remain elevated in certain regions, although there are indications that they may begin to moderate. Interest rates are also likely to play a significant role, influencing borrowing costs for consumers and impacting overall spending.

Influence of Economic Factors on EV Resale Value

Economic conditions directly impact consumer purchasing decisions. High inflation and rising interest rates can reduce disposable income, potentially dampening demand for EVs, especially if they are perceived as a luxury item. Conversely, sustained economic growth and stable inflation could lead to increased consumer confidence and greater adoption of EVs, potentially boosting resale values. The availability of financing options also plays a crucial role.

Government Incentives and Regulations

Government incentives, such as tax credits or subsidies, significantly affect EV adoption rates. Continued or enhanced incentives in 2025 could encourage more consumers to purchase EVs, potentially driving up demand and resale values. Regulations regarding emissions standards and charging infrastructure development also have a crucial impact. For instance, stricter emissions standards could incentivize manufacturers to produce more EVs, increasing supply and influencing pricing.

Impact of Raw Material Costs and Supply Chain Disruptions

Fluctuations in raw material costs, like lithium and nickel, used in EV batteries can significantly impact manufacturing costs. Supply chain disruptions, which are a persistent concern, could lead to increased production costs and reduced availability of EVs. These factors directly influence the pricing of new EVs, which in turn affects their resale value.

Impact of Geopolitical Factors

Geopolitical tensions and conflicts can disrupt global supply chains and influence commodity prices, impacting the availability and cost of EV components. This can lead to uncertainty in the EV market, affecting both new and used vehicle values. For instance, conflicts in regions with significant mineral resources can create volatility in raw material costs, impacting EV production and resale values.

Correlation Between Economic Factors and EV Resale Value

| Economic Factor | Description | Impact on Resale Value |

|---|---|---|

| Inflation | Persistent increase in the general price level of goods and services. | High inflation can reduce consumer purchasing power, potentially lowering demand for EVs and their resale value. |

| Interest Rates | The percentage charged by lenders for the use of borrowed money. | Higher interest rates can increase the cost of financing, potentially decreasing demand for EVs and their resale value. |

| Economic Growth | Increase in the production of goods and services in an economy. | Strong economic growth can increase consumer confidence and spending, potentially boosting demand for EVs and their resale value. |

| Government Incentives | Tax credits, subsidies, or other support for EV purchases. | Increased government incentives can stimulate demand for EVs, potentially leading to higher resale values. |

| Raw Material Costs | Prices of materials used in EV production. | Increased raw material costs can increase the price of EVs, potentially impacting their resale value. |

| Supply Chain Disruptions | Obstacles or delays in the movement of goods through the supply chain. | Disruptions can increase production costs and reduce availability, potentially impacting EV resale values. |

| Geopolitical Factors | International relations, conflicts, and political instability. | Geopolitical tensions can disrupt supply chains and increase raw material costs, potentially impacting EV resale values. |

Industry Analysis

The electric vehicle (EV) market is experiencing rapid growth, and the resale value of these vehicles will play a crucial role in its future trajectory. Understanding the competitive landscape, manufacturer strategies, and consumer preferences is essential to forecasting future trends in the used EV market. Analyzing these factors will provide a clearer picture of the resale value outlook for EVs by 2025.

Competitive Landscape in the 2025 EV Market

The EV market in 2025 will feature intense competition among established automakers and new entrants. This competition will influence pricing strategies, product differentiation, and ultimately, resale values. Key players will likely focus on brand reputation, technological innovation, and consumer experience to gain market share. Factors like charging infrastructure availability, government incentives, and consumer perception of EV reliability will also play a significant role in the competitive landscape.

Strategies of Major EV Manufacturers in the Used Vehicle Market

Manufacturers are adopting various strategies to maximize the resale value of their used EVs. These strategies often involve building brand loyalty and offering attractive trade-in programs. Strategies also extend to maintaining a high level of vehicle quality, which often translates into higher resale values in the secondary market.

Comparison of Used EV Models by Different Manufacturers

Differences in manufacturer reputation, brand loyalty, and perceived quality will impact the resale value of used EVs. Luxury brands, for example, might maintain higher resale values than those of mass-market manufacturers. Factors like battery technology, charging speed, and range will also influence consumer perceptions and affect resale value. A model with superior technology and consistent performance reports may retain a higher value than a model with issues in these areas.

Industry Trends in the Used EV Market

Several trends are shaping the used EV market. The increasing adoption of EVs is driving demand, and the availability of used models will likely influence prices. The growth of the used EV market is expected to be driven by factors like technological advancements in battery technology and charging infrastructure. As more models enter the used market, the need for reliable assessments of vehicle history, battery health, and service records will become more critical.

Resale Value Variation Based on Manufacturer Reputation and Brand Loyalty

Manufacturer reputation and brand loyalty directly influence resale value. A strong brand image can command higher prices for used vehicles, as consumers may be willing to pay a premium for a vehicle from a trusted brand. Conversely, a brand with a poor reputation might see a significant drop in resale value. Consumer reviews, long-term reliability data, and perceived quality are critical elements.

Strategies of Major EV Manufacturers in the Used Vehicle Market

| Manufacturer | Resale Value Strategy | Marketing Approach |

|---|---|---|

| Tesla | Focus on battery technology and vehicle longevity; offering incentives for trade-ins. | Highlighting the superior range and performance of their used EVs; emphasizing the ongoing software updates that improve the vehicle’s functionality. |

| Volkswagen | Promoting a comprehensive service network and providing extended warranties for used models. | Emphasizing the vehicle’s reliability and value proposition; targeting environmentally conscious consumers with a focus on sustainability. |

| General Motors | Leveraging their extensive service network to ensure high-quality maintenance records and reliability for used vehicles. | Utilizing their vast dealer network for efficient sales and service of used EVs; offering competitive pricing to appeal to a broader range of consumers. |

| Ford | Focusing on a balance between affordability and quality in their used models; offering attractive trade-in programs and incentives. | Emphasizing the accessibility and practicality of their used EVs; highlighting the strong reliability of their vehicles. |

Specific Model Analysis

Source: thedigitaltech.com

Predicting the resale value of electric vehicles (EVs) in 2025 requires a nuanced understanding of factors beyond basic market trends. Different models will exhibit varying degrees of appreciation or depreciation based on their specific attributes and market reception. This analysis delves into the projected resale values for popular EV models, considering key factors like performance, features, design, and potential issues like recalls.

Resale Value Projections for Popular EV Models

The anticipated resale values for specific EVs in 2025 will be influenced by factors such as production volumes, technological advancements, consumer demand, and any reported issues. Different models may experience varying levels of market acceptance, leading to fluctuations in their respective resale values.

Tesla Model Y, Resale value electric cars expected 2025

The Tesla Model Y, a popular SUV, is expected to retain a significant portion of its initial value in 2025. Its strong brand reputation, advanced technology, and established customer base contribute to this positive outlook. Early adoption of features like Autopilot and advanced battery technology could be a factor in retaining high resale value. However, competition from similar models with potentially lower prices may impact its long-term value.

Chevrolet Bolt

The Chevrolet Bolt’s resale value in 2025 is projected to be impacted by its relatively lower price point compared to the Tesla Model Y. Consumer perception of its features and performance compared to competitors will play a crucial role. The Bolt’s potential for value depreciation is linked to factors like battery range and charging infrastructure availability. Existing concerns about battery range and reliability could affect its resale value.

Ford Mustang Mach-E

The Ford Mustang Mach-E, a stylish and relatively new EV model, is anticipated to face a more variable resale value trajectory in 2025. Factors like initial sales volume, consumer reception, and any potential recalls will directly influence its resale value. Its unique design and features might attract a loyal following, potentially bolstering its resale value. However, early market adoption issues and competition from other electric SUVs may pose challenges.

Factors Affecting Resale Value

Numerous factors play a critical role in determining the resale value of specific EV models in 2025.

- Performance: High-performance EVs often command premium resale values due to their appeal to enthusiasts. The Tesla Model S, for example, frequently retains a significant percentage of its initial value.

- Features: Advanced features like sophisticated infotainment systems, driver-assistance technologies, and unique design elements can increase the perceived value of an EV model.

- Design: Attractive and innovative designs can increase demand and subsequently, the resale value of an EV model. Models that stand out in the market might command a premium.

- Recalls and Safety Issues: Negative news regarding safety issues or recalls can significantly reduce the resale value of an EV model. A history of issues can deter potential buyers and lower the model’s market appeal.

Resale Value Projection Table (2025)

| Model | Estimated Resale Value (2025) | Factors Affecting Value |

|---|---|---|

| Tesla Model Y | 70-80% of original MSRP | Strong brand, advanced technology, established customer base, potential competition. |

| Chevrolet Bolt | 60-70% of original MSRP | Lower price point, battery range and charging infrastructure concerns, consumer perception compared to competitors. |

| Ford Mustang Mach-E | 65-75% of original MSRP | Unique design, potential for loyal following, initial sales volume, consumer reception, potential recalls, competition from other electric SUVs. |

Closing Notes

In conclusion, the resale value of electric cars in 2025 is expected to be influenced by a confluence of factors, including technological advancements, consumer behavior, and economic conditions. While precise predictions are difficult, the overall trend suggests a complex interplay of positive and negative factors. The future of EV resale value hinges on the ability of manufacturers to meet evolving consumer needs and adapt to the ever-changing market landscape.

Post Comment